Managing My Family Monthly Expenses Through Lean Six Sigma

Sendil Mourougan | [email protected]

Unique No.: 2015-1

Abstract

Lean Six Sigma is an improvisation process. It can be applied to every sector – healthcare sector, business, customer care including personal life. In this paper, I have shared my personal experience of how I managed my income within the planned monthly budget using Lean Six Sigma approach. I have presented the same using the DMAIC step-by-step approach so that it will help the interested ones to understand and apply them for their personal life too. This paper is based on my own experience. All the data, inputs and outputs presented here are related to my life.

Key words: Lean Six Sigma, DMAIC, Pareto chart, Project Life cycle (PLC), SIPOC

Introduction

There were mutiple instances where I could not control my expenses within the income earned. In frustration over failing to make rapid improvements in managing expenses on my own, I came to know about the Lean Six Sigma concept through an official training. While having a casual conversation with the faculty who handled the training session, he told me that Six Sigma can help to improve our personal life too in various aspects. I gained more interest and started learning the concept in depth. Since my major pain point was to manage my expenses, I applied the concept and I could discover the expected benefits.

Lean Six Sigma application in managing my expenses

- About Lean Six Sigma

- Lean Six Sigma help to identify the root cause of waste. Lean Six Sigma utilizes the DMAIC step-by-step approach to eliminate waste and create a most efficient system to achieve the desired results. I have discussed below the DMAIC approach that I have deployed to manage my expenses.

- Context

- It is very important to control the monthly expenses to avoid financial debts in life. Six Sigma provides a systematic step-by-step approach to solve the problem through 7 basic quality tools like the Pareto chart and the Control charts which I have used here to control my expenses.

- Total PLC: 180 days

- Start Date: 11th January, 2015

- End Date: 10th July, 2015

- Project Details (DMAIC Process): Controlling Expenses

Define phase

- Timeline: 10 days

- Start Date: 11th January, 2015

- End Date: 21st January, 2015

Problem Statement: There is a high proportion of spending compared to the income received.

Goal Statement: Ensuring monthly expenses are within the 12K budget with 30% savings from 26K income earned.

Scope: The scope of the project included all monthly expenses and monthly income earned.

I started the define phase using a Six Sigma tool SIPOC (Suppliers, Inputs, Process, Outputs, Customers). This helped to create a process map which clearly showed how my income was received and how it was spent on various expenses. As next step, I created CTQ (critical-to-quality) parameters to bifurcate the fixed and variable expenses. Fixed expenses included credit card monthly dues. Variable expenses included food expenses, weekly outing expenses, electricity and water bills, mobile bills and petrol expenses. A timeline was fixed for each phase of my saving initiative as discussed in each phase.

Measure Phase

- Timeline: 20 days

- Start Date: 22nd January, 2015

- End Date: 10th February, 2015

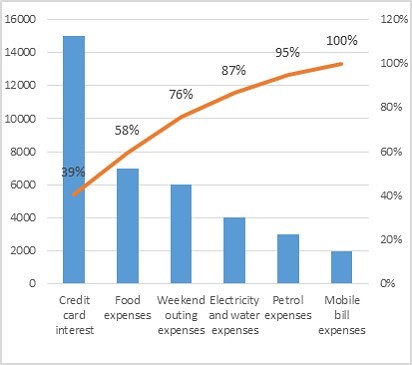

During this phase, I collected data for all expenses incurred; income received and plotted them in a Pareto chart. The Pareto chart provides a graphic depiction of the Pareto principle, a theory maintaining that 80% of the output in a given situation or system is produced by 20% of the input.

The Pareto chart is one of the seven basic tools of quality control. The independent variables on the chart are shown on the horizontal axis and the dependent variables are portrayed as the heights of bars. It is a point-to-point graph, which shows the cumulative relative frequency. Because the values of the statistical variables are placed in order of relative frequency, the graph clearly reveals which factors have the greatest impact and where attention is required to yield the greatest benefit.

The expenses were categorized as controllable and uncontrollable expenses. Credit card interests were considered as uncontrollable expenses because they needed to be paid every month without any change in the regular payment. The controllable expenses were Food expenses, Weekend outing expenses, Mobile bill expenses and Petrol expenses.

| Expenses | Jan-15 | Cumulative Frequency |

| Credit card interest | 14563 | 39% |

| Food expenses | 7256 | 58% |

| Weekend outing expenses | 6523 | 76% |

| Electricity and water expenses | 4085 | 87% |

| Petrol expenses | 3000 | 95% |

| Mobile bill expenses | 2032 | 100% |

| Total | 37459 |

I created a Pareto chart as shown below to compare the different causes of expenses and to find out where attention is required to yield the greatest benefit.

The first four causes were considered for improvement. I took these on for further study that highlighted my average controllable expenses as 8,100 rupees per month. Credit card interests were further drilled down by using a Pareto chart, from which interest charges, EMI and late-fee charges were taken into consideration.

Analyze Phase

- Timeline: 18 days

- Start Date: 11th February, 2015

- End Date: 28th February, 2015

- Credit card interest analysis

- In this phase I created a cause-and-effect diagram for credit card usage. Out of all the causes listed, only two had the highest impact. They were:

- Blindly believed the credit card statement

- Buying unwanted stuff frequently

- Analysis for the first cause was the rate of interest and charges that were charged were huge. The analysis for the second cause was that I bought unwanted fancy dress materials for my family through online shopping because of attractive advertisements like buy 2 get 3 free for stock clearance sale.

- In this phase I created a cause-and-effect diagram for credit card usage. Out of all the causes listed, only two had the highest impact. They were:

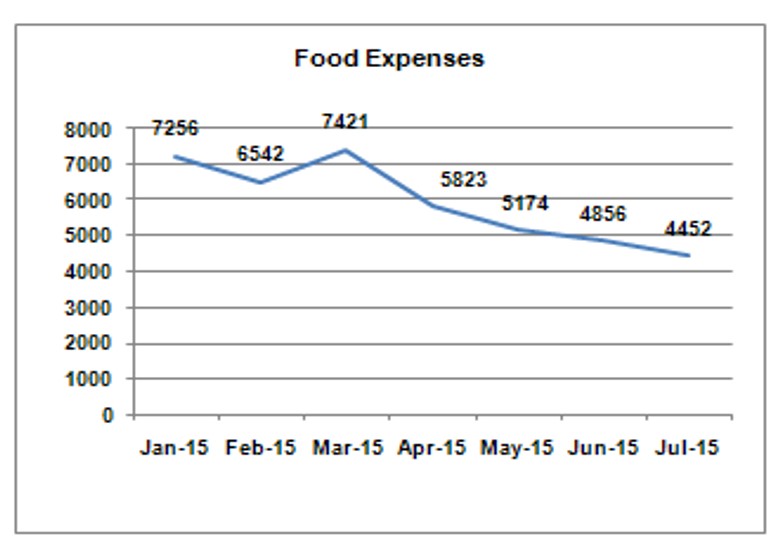

- Food expenses analysis

- On analysis, I found more money is being drained out for junk foods and soft drinks. On seeing the attractive food products launched, importance was given for purchasing the same without thinking of their side effects on health.

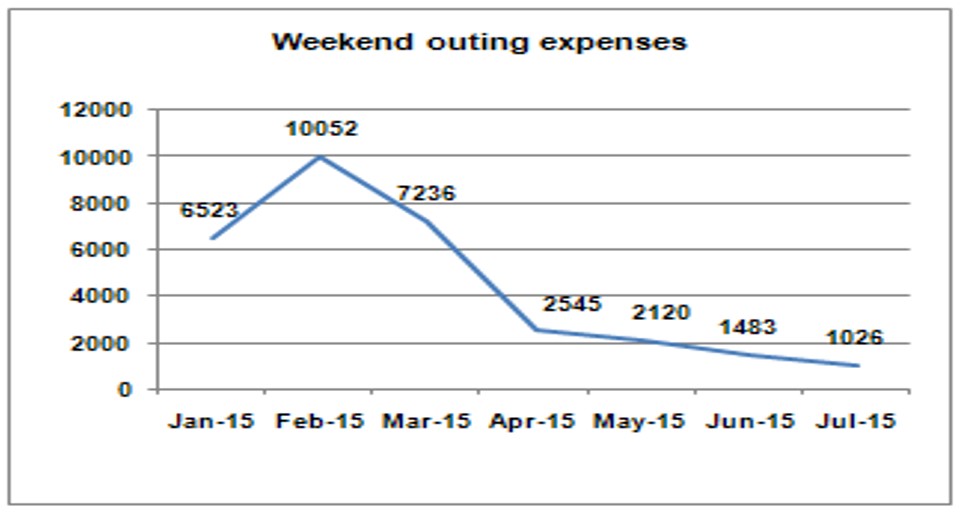

- Weekend outing expenses analysis

- I found on weekends a part of the unbudgeted amount being spent in cinema and hotels. New releases are seen in theatres which included ticket expenses for the family, junk food expenses spent in theatres and car parking expenses in the theatre.

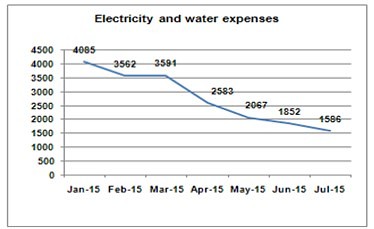

- Electricity and water bill expenses analysis

- It was found on analysis that consumption of electricity and water usage was more. Utilization time of TV and A/C formed the major part in the hike of electricity expenses. Amount of water used for gardening and road wash outside the house two times on a daily basis was also more. Likewise, when we are sitting in the living room, we did not turn off the lights in the bedroom. If we required only 1 glass of water, we found 2 glasses of water were wasted while collecting the water from the purifier machine.

Improve Phase

- Timeline: 45 days

- Start Date: 1st March, 2015

- End Date: 15th April, 2015

I created a plan along with my wife Valarmathi to reduce my credit card expenses and to clear off the already existing dues. I sold some jewels to clear my credit card dues. This helped me to free myself from the interest paid every month from my salary. But the pain I had in selling my jewels was more and it made me to realize a lot about the mistake done in using credit card often for purchasing the unwanted stuff. At that moment, I decided not to be carried away by the attractive advertisements. I passed on the message to my family members and the impact of those desires, on my earnings and interest paid.

Together as a family we reduced our outing and food expenses. We also realized the amount spent on medical expenses due to the effect of junk foods. A monthly savings plan was worked out. The savings that will come by reducing these expenses was calculated and a monthly savings plan was arrived for the future. We thought of going for a family medical insurance from the savings plan so that the credit card interest amount, junk food and outing expenses can be redirected as premium payment for insurance.

We also realized the necessity of resources for the next generation. Accordingly the usage of electricity and water reduction plan was worked out. The savings arising out of this reduction plan will be redirected to other necessary monthly expenses for the family.

We planned to implement all the improvement actions in a month’s time, and collect data again three months after the improvements were made.

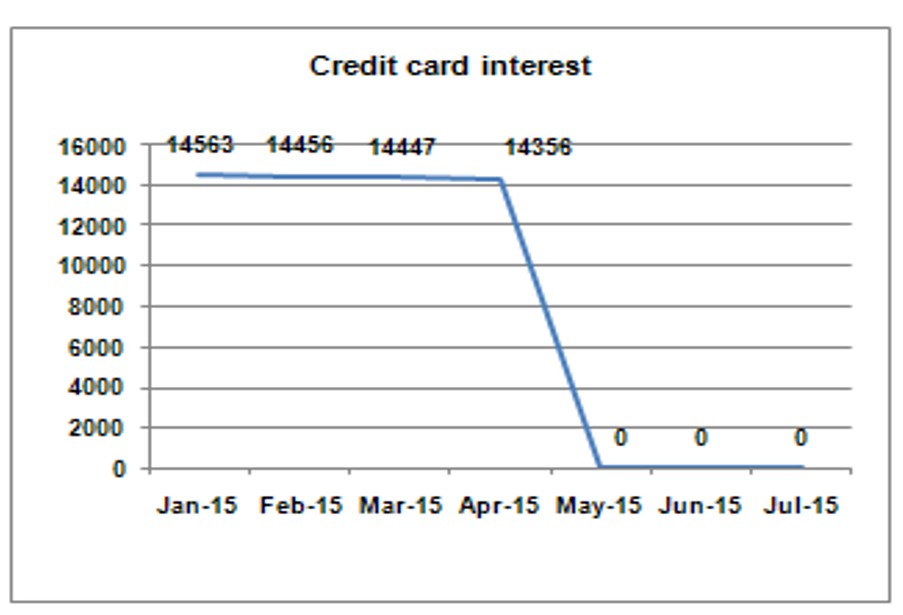

Control Phase

- Timeline: 85 days

- Start Date: 16th April, 2015

- End Date: 10th July, 2015

After the implementation of the action plan, a comparison trend chart was created to compare the results of three months of pre-improvement expenses data with the three months of post-improvement expenses data. The drastic improvement was also realized through 30% savings which is the real outcome of the exercise I have done through Lean Six Sigma approach. The improvements were monitored using trend cards in the form of a dash board shown below. We are sustaining the expenses amount by building controls and to bring down other expenses like petrol and mobile.

Conclusion

Six sigma approach changed my mind set. It showed me a direction to manage my expenses through a systematic approach. My monthly expenses got reduced from 37K to 12K in six months period. My goal statement was successfully met i.e. managing my 26K income within 12K expenses budget and with 30% savings. Next month I have planned to invest the savings realized in a family health insurance. Based on the results obtained out of this exercise, enthusiasm started within me and I have now started to apply the same concept to manage my time. My wife started applying it to manage her kitchen.